Introduction:

Economics is a field of study that has become increasingly relevant in our globalized, financialized society. The economy is part of our collective conscious and a buzzword that links personal finances to big business and international trade deals. Economics deals with individual choice, but also with money and borrowing, production and consumption, trade and markets, employment and occupations, asset pricing, taxes and much more. What then is the definition of economics? One way to think of it is the study of what constitutes rational human behavior in the endeavor to fulfill needs and wants given a world with scarce resources. In other words, economics tries to explain how and why we get the stuff we want or need to live. How much of it do we get? Who gets to have more? Who makes all this stuff? How is it made? These are the questions and decisions that economics concerns itself with.

As an individual, for example, you constantly face the problem of having limited resources with which to fulfill your wants and needs. As a result, you must make certain choices with your money – what to spend it on, what not to spend it on, and how much to save for the future. You'll probably spend part of your paycheck on relative necessities such as rent, electricity, clothing and food. Then you might use the rest to go to the movies, dine out or buy a smartphone. Economists are interested in the choices you make, and investigate why, for instance, you might choose to spend your money on a new Xbox instead of replacing your old pair of shoes. They would want to know whether you would still buy a carton of cigarettes if prices increased by $2 per pack. The underlying essence of economics is trying to understand how individuals, companies, and nations as a whole behave in response to certain material constraints.

Adam Smith (1723 - 1790), is often considered the "father of modern economics." His book "An Inquiry into the Nature and Causes of the Wealth of Nations" (1776) was the first fully elaborated attempt to understand why some nations prospered while others suffered widespread poverty. He famously argued that individuals working for their own self-interest could nonetheless create a stable and well-provisioned society through a mechanism he called the invisible hand of the market. (See also: 'Adam Smith and 'The Wealth Of Nations.')

Smith, however, was not the first to write on economic matters. Other scholars of what was then known as political economy wrote prior to "The Wealth of Nations," but Adam Smith was one of the first to identify the unique economic changes that accompanied the birth of industrialization and capitalist production. Smith’s work was followed by David Ricardo’s "Principles of Political Economy and Taxation" (1817) and later by Karl Marxin "Capital" (1867). Each of these authors sought to explain how capitalism worked and what it meant for producers and workers in the capitalist system. (See also: What is the difference between Communism and Socialism?)

In the late 19th century, the discipline of economics became its own distinct field of study. Alfred Marshall, author of "The Principles Of Economics" (1890) defined economics as a social science that examines people's behavior according to their individual self-interests. He wrote, "Thus it is on one side the study of wealth; and on the other, and more important side, a part of the study of man." In the early 20th century, however, there was a push toward legitimizing economics as a rigorous science alongside the physical sciences like chemistry and physics. As a result, mathematical models and statistical methods were brought to the forefront along with a number of strong assumptions that are needed to make those models work. For example, modern mainstream economics makes the assumption that human beings will always aim to fulfill their individual self-interests. It also assumes that individuals are rational actors in their efforts to fulfill their unlimited wants and needs. It also makes the claims that firms exist to maximize profit and that markets are efficient. This school of economics, which has come to dominate both the academic field of economics as well as the practical application of economic theory in policy and business, is known as neoclassical economics.

Kinds of Economic Systems:

Traditional Economic System

The traditional economic system is the most traditional and ancient types of economies in the world. Vast portions of the world still function under a traditional economic system. These areas tend to be rural, second- or third-world, and closely tied to the land, usually through farming. In general, in this type of economic system, a surplus would be rare. Each member of a traditional economy has a more specific and pronounced role, and these societies tend to be very close-knit and socially satisfied. However, they do lack access to technology and advanced medicine.

Command Economic System

In a command economic system, a large part of the economic system is controlled by a centralized power. For example, in the USSR most decisions were made by the central government. This type of economy was the core of the communist philosophy.

Since the government is such a central feature of the economy, it is often involved in everything from planning to redistributing resources. A command economy is capable of creating a healthy supply of its resources, and it rewards its people with affordable prices. This capability also means that the government usually owns all the significant industries like utilities, aviation, and railroad.

In a command economy, it is theoretically possible for the government to create enough jobs and provide goods and services at an affordable rate. However, in reality, most command economies tend to focus on the most valuable resources like oil.

Advantages of Command Economic Systems

- If executed correctly, the government can mobilize resources on a massive scale. This mobility can provide jobs for almost all of the citizens.

- The government can focus on the good of the society rather an individual. This focus could lead to a more efficient use of resources.

Disadvantages of Command Economic Systems

- It is hard for the central planners to provide for everyone’s needs. This forces the government to ration because it cannot calculate demand since it sets prices.

- There is a lack of innovation since there is no need to take any risk. Workers are also forced to pursue jobs the government deems fit.

Market Economic System

In a free market economy, firms and households act in self-interest to determine how resources get allocated, what goods get produced and who buys the goods. This is opposite to how a command economy works, where the central government gets to keep the profits.

There is no government intervention in a pure market economy (“laissez-faire“). However, no truly free market economy exists in the world. For example, while America is a capitalist nation, our government still regulates (or attempts to control) fair trade, government programs, honest business, monopolies, etc.

In this type of economy, there is a separation of the government and the market. This separation prevents the government from becoming too powerful and keeps their interests aligned with that of the markets.

Hong Kong has been seen as an example of a free market society.

Advantages of a Free Market Economy

- Consumers pay the highest price they want to, and businesses only produce profitable goods and services. There is a lot of incentive for entrepreneurship.

- This leads to the most efficient use of the factors of production since businesses are very competitive.

- Businesses invest heavily in research and development. There is an incentive for constant innovation as companies compete to provide better products for consumers.

Disadvantages of a Free Market Economy

- Due to the fiercely competitive nature of a free market, businesses will not care for the disadvantaged like the elderly or disabled. This leads to higher income inequality.

- Since the market is driven solely by self-interest, economic needs have a priority over social and human needs like providing healthcare for the poor. Consumers can also be exploited by monopolies.

Mixed Economic System

A mixed economy is a combination of different types of economic systems. This economic system is a cross between a market economy and command economy. In the most common types of mixed economies, the market is more or less free of government ownership except for a few key areas like transportation or sensitive industries like defense and railroad.

However, the government is also usually involved in the regulation of private businesses. The idea behind a mixed economy was to use the best of both worlds – incorporate policies that are socialist and capitalist.

To a certain extent, most countries are mixed economic system. For example, India and France are mixed economies.

Advantages of Mixed Economies

- There is less government intervention than a command economy. This means that private businesses can run more efficiently and cut costs down than a government entity might.

- The government can intervene to correct market failures. For example, most governments will come in and break up large companies if they abuse monopoly power. Another example could be the taxation of harmful products like cigarettes to reduce a negative externality of consumption.

- Governments can create safety net programs like healthcare or social security.

- In a mixed economy, governments can use taxation policies to redistribute income and reduce inequality.

Disadvantages of Mixed Economies

- There are criticisms from both sides arguing that sometimes there is too much government intervention and sometimes there isn’t enough.

- A common problem is that the state run industries are often subsidized by the government and run into large debts because they are uncompetitive.

Production Possibility Frontier

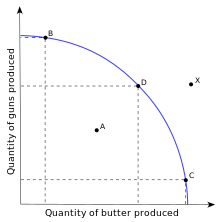

A production–possibility frontier (PPF) or production possibility curve (PPC) is the possible tradeoff of producing combinations of goods with constant technology and resources per unit time. One good can only be produced by diverting resources from other goods, and so by producing less of them. This tradeoff is usually considered for an economy, but also applies to each individual, household, and economic organization.

Graphically bounding the production set for fixed input quantities, the PPF curve shows the maximum possible production level of one commodity for any given production level of the other, given the existing state of technology. By doing so, it defines productive efficiencyin the context of that production set: a point on the frontier indicates efficient use of the available inputs (such as points B, D and C in the graph), a point beneath the curve (such as A) indicates inefficiency, and a point beyond the curve (such as X) indicates impossibility.

The PSU represented by the point on the PPF where an efficient economy operates (which is obtained by tangency with the highest individual or social indifference curve, not shown in the graph) presents the priorities or choices of the modeled agent, such as the choice of having more butter produced and fewer guns, or vice versa.

PPFs are normally drawn as bulging upwards or outwards from the origin ("concave" when viewed from the origin), but they can be represented as bulging downward (inwards) or linear (straight), depending on a number of assumptions. A PPF illustrates several economic concepts, such as scarcity of resources (the fundamental economic problem that all societies face), opportunity cost (or marginal rate of transformation), productive efficiency, allocative efficiency, and economies of scale.

An outward shift of the PPF results from growth of the availability of inputs, such as physical capital or labour, or from technological progress in knowledge of how to transform inputs into outputs. Such a shift reflects, for instance, economic growth of an economy already operating at its full productivity (on the PPF), which means that more of both outputs can now be produced during the specified period of time without sacrificing the output of either good. Conversely, the PPF will shift inward if the labor force shrinks, the supply of raw materials is depleted, or a natural disaster decreases the stock of physical capital.

However, most economic contractions reflect not that less can be produced but that the economy has started operating below the frontier, as typically, both labor and physical capital are underemployed, remaining therefore idle.

No comments:

Post a Comment